Now-a-days, we have been observing that the Stock market is crashing daily and reaching new lows.

Is it Good or Bad? My answer is, it is not only good but TOO GOOD for long-term investors.

Stock markets are going down due to several reasons including

- Earnings growth not picking up in Indian companies,

- Certain global factors such as drastic fall in crude oil prices,

- US & China’s slowdown, FIIs exiting etc.,

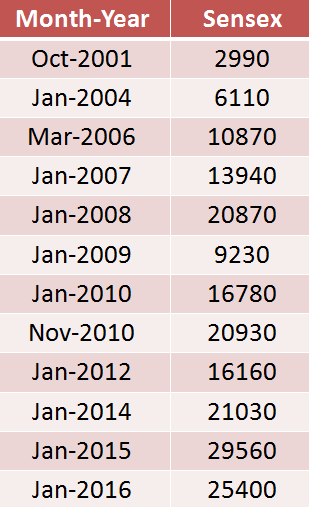

Is it the first time Stock markets are crashing? Ofcourse NO. Look at the below Sensex graph from 1999 to Jan-2016. Sensex is a broad market indicator and is calculated using Share prices of Top 30 companies by Market capitalisation.

Ups and downs are inherent in Stock market. Volatility is part and parcel of Stock Market investments. Investments of Mr. Warren Buffet, who is the world’s greatest investor, went down by 50% around 6 – 7 times in his investment life time of 65 yrs.

One can observe that there have been many Ups and Downs in the Sensex, but the overall long-term slope has been +ve, which means, if invested in Stock market, your money will grow in value in long-term irrespective of Short-term volatility. The best way to take care of volatility is to invest through SIPs in mutual funds because you will invest every month at different Sensex levels which will average out your cost.

Sensex over last 15 years

If you observe the Sensex figues in the above table, Sensex has risen and fallen many times, but

- Sensex rose from 2990 in Oct-2001 to 25400 in Jan-2016, which is equivalent to a return of 15.33% p.a.

- Historically, Mutual fund returns are ~ 5-10% more than Sensex returns.

- SIP returns are ~ 5-7% more than the returns from lumpsum investments

Please read the above 3 points carefully. It only proves that in the long-term Stock market / Mutual funds / Sensex have given very good returns.

Now, with Sensex crashing to 25000 levels (in Jan-16) from the levels of 30000 (in Jan-15), is it good time to invest? Absolutely YES. Now, Shares of good companies and Mutual Funds units are available at cheaper prices / valuations. When there is a discount sale in a Shopping Mall, will you buy? Similar situation is prevalent in Stock market now. Its shopping (investing) time. Go on and invest either lumpsum amounts in Mutual Funds or start SIPs (ever-green mode to invest) in Mutual Funds to get good companies at Discounted Prices.

When everyone is afraid and exiting the market, its the right time to buy. Why is it so? From the above table, Sensex was 20870 in Jan-2008 and it crashed to 9230 by Jan-2009. Jan-2009 was a very good time to invest but people were afraid to enter the Stock market. Had some body invested at those levels, he would have doubled his money in just 1.5 years because sensex rebounded to 20930 level by Nov-2010.

Conclusion:

No need to panic if the Stock market falls. Its good time to invest akin to discount sale in a Shopping mall.

Stock market will recover in a short time. But if you don’t invest now, you will miss a good opportunity.